Comparing the Big Three: South Africa's Top Life Insurance Companies and Their Hidden Treasures (2025)

So you're searching for the best life insurance policy in South Africa? I get it – diving into the world of premiums, benefits, and policy jargon feels about as fun as filing your tax return. But here's the thing: behind all those numbers lies something pretty fascinating – rewards programs that could literally put thousands of rands back in your pocket over time while providing essential protection for your family.

I've spent the last 5 years helping clients navigate these waters, and today I'm pulling back the curtain on what South Africa's three insurance giants – Momentum, Old Mutual, and Sanlam – are really offering beyond the basic coverage. Not sure where to start? Get a free personalized quote here.

South African Life Insurance Comparison Methodology

For this comprehensive life insurance comparison in South Africa, I've gathered fresh life insurance quotes from all three major providers based on identical parameters:

- 35-year-old male professional with a four-year degree

- Non-smoker with standard health

- R2,000,000 death benefit

- R1,000,000 disability coverage

- R1,000,000 critical illness coverage

- R1,000,000 accidental death coverage

I've been a FAIS Accredited Representative for years helping South Africans find affordable life insurance solutions, and what I've learned is that the devil is in the details – especially when it comes to those loyalty programs and "bonus" features that insurers love to highlight in their brochures.

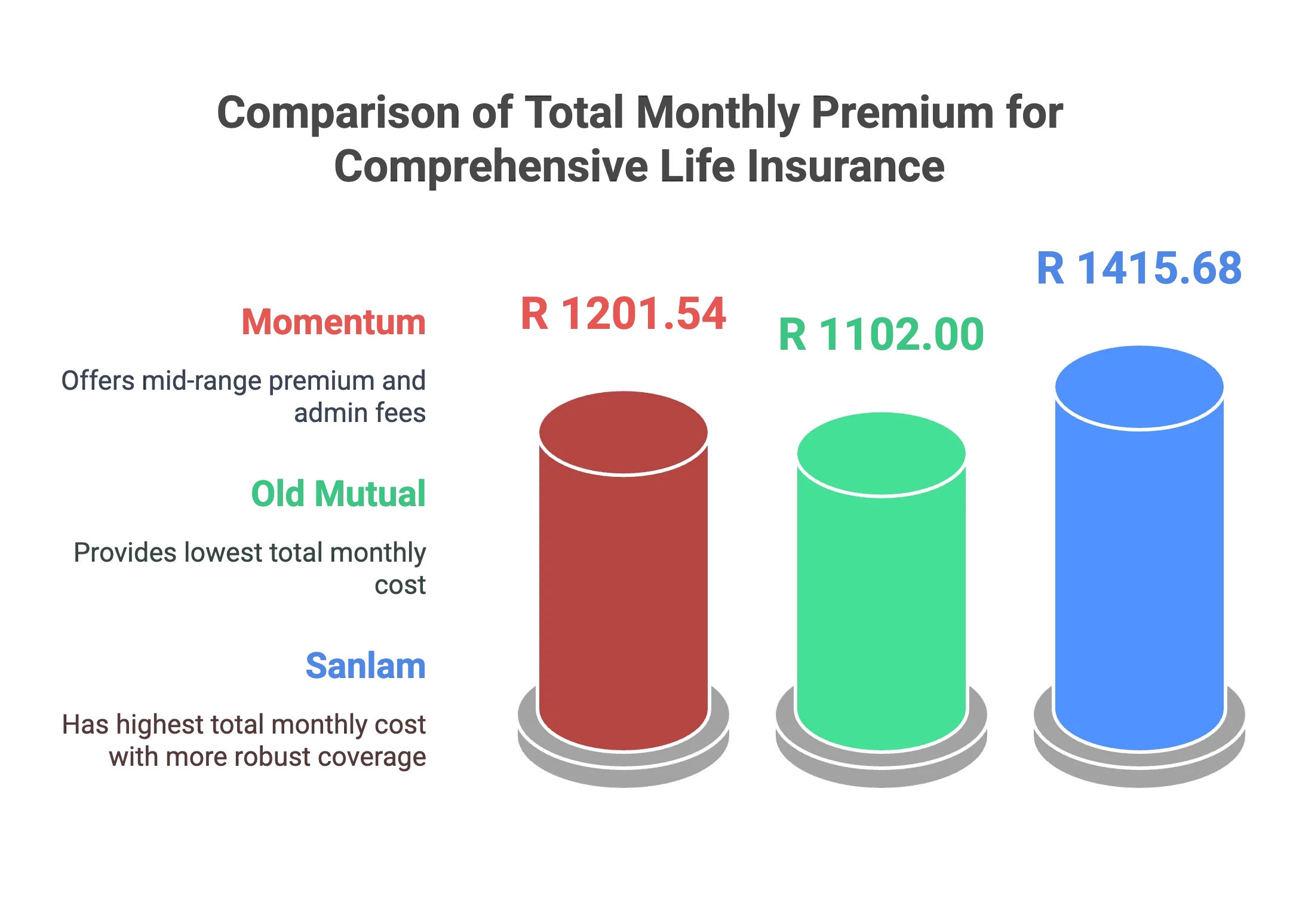

Life Insurance Premium Comparison: Momentum vs Old Mutual vs Sanlam

Let's cut to the chase – here's what you'd pay monthly for comparable coverage with these top life insurance companies in South Africa. These premiums apply to our 35-year-old male professional example with the coverage amounts mentioned above:

| Company | Base Monthly Premium | Admin Fee | Total Monthly Cost |

|---|---|---|---|

| Momentum | R1,171.54 | R30.00 | R1,201.54 |

| Old Mutual | R1,082.00 | R20.00 | R1,102.00 |

| Sanlam | R1,355.15 | R20.00 | R1,415.68 |

My first thought? Old Mutual appears to offer the most attractive initial premium. But as my grandmother used to say, "The cheapest boot isn't always the best value." Let's dig deeper. Want to see what premiums you qualify for? Request an instant quote from Sanlam, Old Mutual and Momentum.

Core Life Insurance Coverage Comparison: Policy Benefits Analysis

All three insurers offer solid coverage, but with subtle differences:

Death Benefits

All three provide the R2,000,000 coverage requested, with automatic annual increases of 5% to help combat inflation. One distinction: Momentum's death benefit includes an "instant cash" feature that pays 10% of the benefit amount (up to R50,000) within 24 hours of a valid claim submission – helpful for immediate expenses while the full claim processes. Not sure how much coverage you need? Use our Life Insurance Coverage Calculator to get a personalized estimate.

Disability Coverage

Here's where things get interesting:

- Momentum offers "Comprehensive Disability" with continued disability coverage for 12 months even if you stop working for reasons other than retirement (like retrenchment).

- Old Mutual includes their "Disability Cover" with a 5-year guarantee term and cashback option.

- Sanlam provides "Comprehensive Disability Plus" with coverage for occupational disability plus certain impairments even if you can still work.

The subtle difference? Sanlam explicitly excludes sports professionals and pilots from occupational disability coverage, while the others don't mention this limitation in their quotes.

Critical Illness Coverage

All three offer comprehensive critical illness coverage with 100% payout across all SCIDEP severity levels (this is the industry standard for critical illness definitions).

However, Momentum's "Complete Enhanced Critical Illness Benefit" includes their "Breadth of Cover Guarantee" – essentially promising to match competitors' coverage for conditions they might miss.

South Africa's Life Insurance Reward Programs: Additional Benefits Comparison

Now for the good stuff – the perks that could potentially return thousands of rands over the life of your policy.

Momentum Life Insurance: LifeReturns and Retirement Booster Programs

Momentum's approach centers around two distinct value-adds: the LifeReturns discount program and their Retirement Booster.

The LifeReturns program works as a premium discount system that can reduce your monthly payments by up to 15%. This discount is calculated based on several health and lifestyle factors:

- BMI (Body Mass Index) screening results

- Blood pressure screening results

- Medical aid membership

- Fitness activity and screening results

- Regular debit order payments

From the quote provided, Momentum offers a "New business special offer discount" of 15.00% (valid until 2027/04/01) and a "LifeReturns Reassessment Protector" that ensures a minimum discount of 10% if you complete the compulsory annual reassessments. If your screening results decline, your discount will not reduce by more than five percentage points per year.

Meanwhile, the Retirement Booster works completely differently. It allocates a percentage of your premiums to a retirement savings vehicle, provided you're a member of a qualifying Momentum Retirement Annuity. Based on the quote, if you maintain your policy until retirement, you could accumulate approximately R399,231 in your Retirement Booster.

The Retirement Booster allocation is calculated as follows:

- For standard benefits: 1.5% of premiums paid

- For Longevity Protector benefits: Triple allocation (4.5%)

| Timeline | Projected Retirement Booster Value |

|---|---|

| Year 1 | R7,585 |

| Year 15 | R184,788 |

| At Retirement | R399,231 |

This is quite different from Sanlam's Wealth Bonus, which uses a different structure entirely.

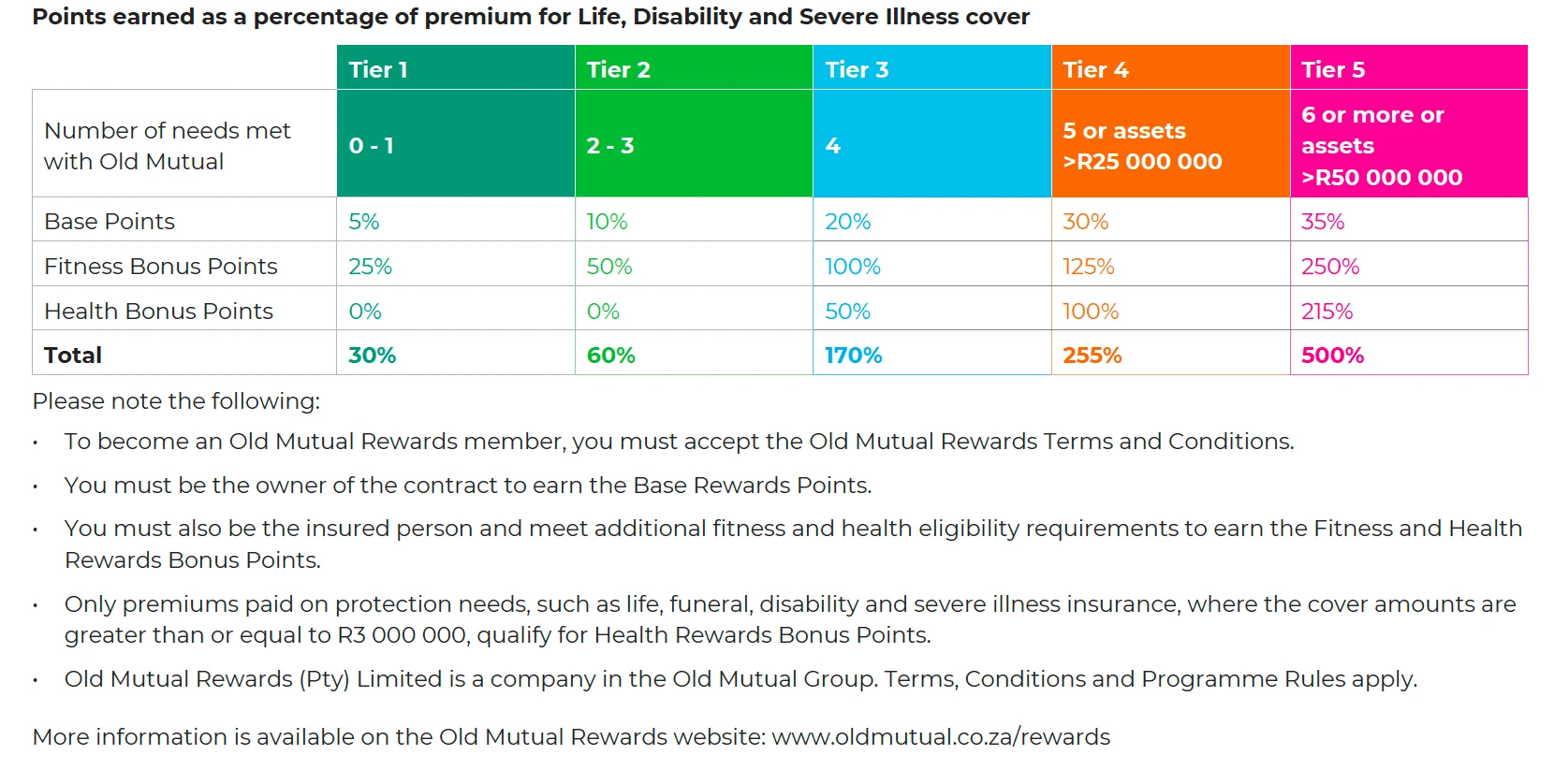

Old Mutual Life Insurance: Rewards Program Benefits

Old Mutual takes a different approach with their Rewards program that could earn you up to 5510 Old Mutual Rewards points (worth approximately R551) monthly if you reach their top tier.

This rewards structure is tiered based on your engagement with Old Mutual products:

| Tier | Requirements | Base Points | Fitness Bonus | Health Bonus | Total |

|---|---|---|---|---|---|

| 1 | 0-1 needs met | 5% | 25% | 0% | 30% |

| 5 | 6+ needs or assets >R50m | 35% | 250% | 215% | 500% |

I like that their approach rewards healthy lifestyle choices, with significant bonuses for fitness activities and health screening results.

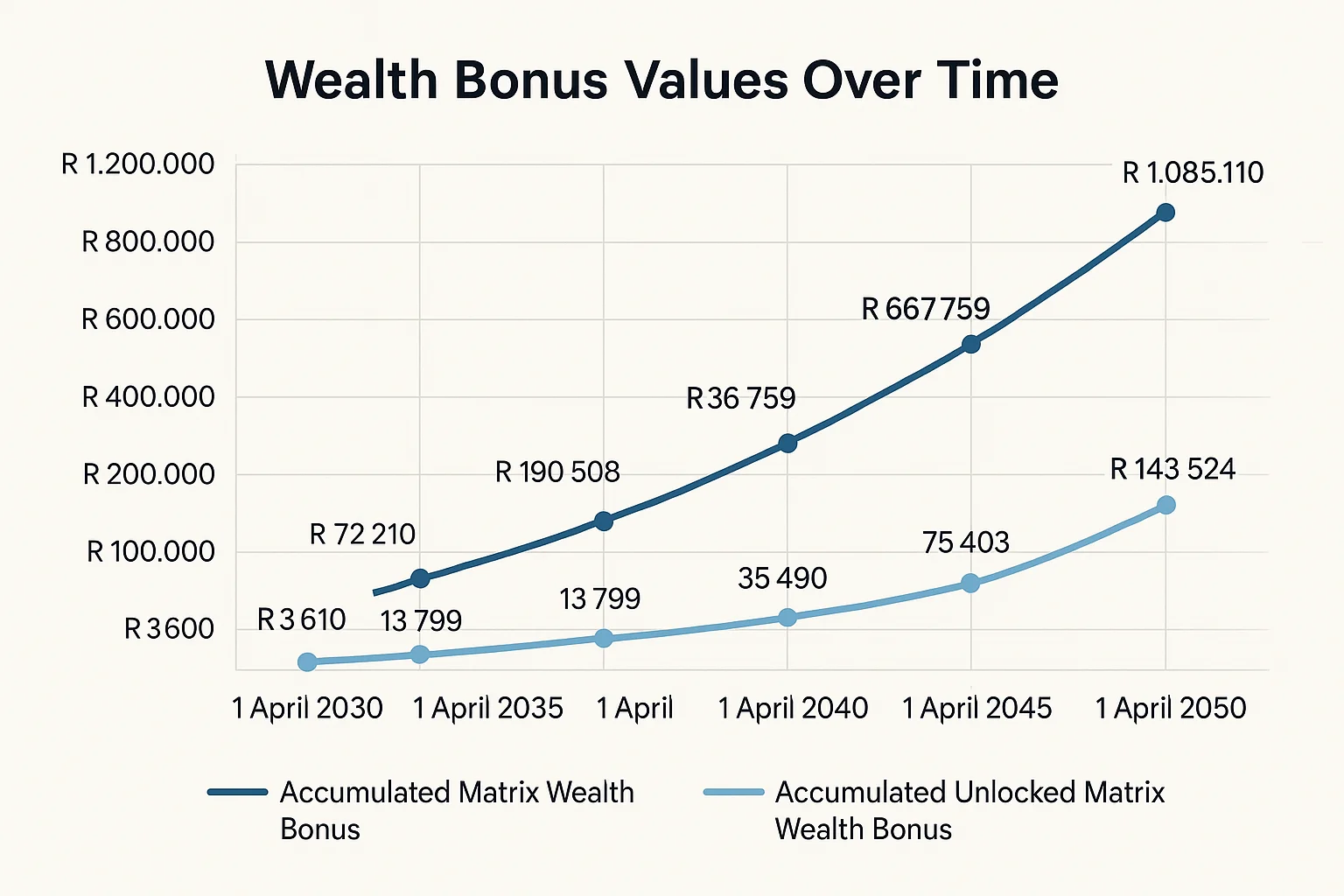

Sanlam Life Insurance: Wealth Bonus and Extended Wealth Bonus Features

Sanlam's approach is perhaps the most straightforward. Their Wealth Bonus matches a percentage of your premium, which grows with interest. The example quote shows a projected Wealth Bonus value of R1,679,816 by 2055.

What makes Sanlam's offering unique is their "Extended Wealth Bonus" – after your Matrix Wealth Bonus unlocks, you begin accumulating a new bonus pool. At ages 75, 80, 85, and 90, 50% becomes available for withdrawal (with the first unlock date at age 75 in 2060).

Life Insurance Cash-Back Features: Comparing Return Policies

Both Old Mutual and Sanlam offer "cashback" features, but they work quite differently:

- Old Mutual includes Cashback with a 5-year guarantee term, costing R123 monthly for all benefits.

- Sanlam's Cashback premium is substantially higher at R361.84 monthly.

The first payout for both comes after 15 years. Based on the quotes, Sanlam's projected cashback amount in year 16 would be R361,403 – substantial, but you're paying for it in higher premiums.

Long-Term Life Insurance Premium Patterns in South Africa

One critical factor that's easy to overlook is how premiums develop over time:

| Year | Momentum | Old Mutual | Sanlam |

|---|---|---|---|

| 1 | R1,201.54 | R1,102.00 | R1,415.68 |

| 5 | R1,744.12 | R1,890.69 | R2,096.51 |

| 10 | R2,914.89 | R3,689.14 | R3,489.64 |

| 15 | R5,011.70 | R7,170.40 | R5,957.28 |

| 20 | R8,728.80 | R11,782.19 | R9,253.45 |

What jumps out at me is that while Old Mutual starts with the lowest premium, by year 20, it becomes the most expensive option. This highlights why looking at long-term projections is so critical.

Life Insurance Claims Process Comparison: Momentum, Old Mutual, and Sanlam

Having walked clients through numerous claims, I've learned that the smoothness of the claims process can be as important as the coverage itself:

- Momentum offers an "Instant Cash" feature, paying 10% of death benefits within 24 hours.

- Old Mutual emphasizes their streamlined digital claims process.

- Sanlam features their "Protector Umbrella Trust" which ensures benefit payments are used appropriately if you suffer from mental debilitation.

Best Life Insurance in South Africa: Which Provider Should You Choose?

After poring over these quotes and drawing on my experience with all three providers, here's my honest assessment:

Momentum might be right for you if:

- You value immediate partial payout for death claims

- You appreciate comprehensive critical illness coverage

- The LifeReturns program aligns with your long-term financial planning

Old Mutual might be right for you if:

- Initial premium affordability is your priority

- You're health-conscious and can maximize their rewards program

- You prefer a simpler rewards structure that can be used for various purposes

Sanlam might be right for you if:

- You're planning very long-term (the Extended Wealth Bonus has significant value if you live past 75)

- You appreciate their comprehensive disability coverage

- The trustee provisions for mental incapacitation align with your concerns

Life Insurance Discounts: How South African Providers Adjust Premiums

I'd be remiss not to mention that both Sanlam and Old Mutual offer loyalty program discounts that aren't reflected in the base quotes:

- With Sanlam Reality membership (Reality Plus option), your R1,355.15 premium could drop to R948.61 at the Gold tier.

- Old Mutual's Rewards program at Tier 5 could provide significant value back each month.

These discounts can substantially change the value proposition, potentially making Sanlam more competitive than it first appears.

South African Life Insurance FAQ: Common Questions About Providers

When comparing best life insurance companies in South Africa, financial stability is crucial. All three are financially sound, but Sanlam is the largest insurance company in Africa by market capitalization, followed by Old Mutual and Momentum.

Absolutely. Our life insurance comparison tool provides standardized quotes, but all three companies offer highly customizable policies to suit your specific protection needs and budget.

All three South African life insurance companies offer a grace period (typically 30 days) to make up missed payments before coverage lapses, which is an important consideration when seeking affordable life insurance that fits your budget.

No. The rewards structures can change, and projections are based on current company policies.

Yes. The projected increases are based on the premium patterns you select and inflation adjustments. Fixed compulsory increase patterns (like Sanlam's 5%) provide more predictability when planning for long-term affordable life insurance in South Africa.

Final Verdict: Best Life Insurance Provider in South Africa for 2025

If I've learned anything in my years using our proprietary life insurance comparison tools and advising clients, it's that finding the best life insurance policy in South Africa isn't just about the cheapest premium today – it's about value over the life of the policy.

Based purely on the life insurance quotes from South Africa's top providers and assuming all else equal:

Compare Top Insurance Providers Now

- For short-term affordability: Old Mutual edges out the competition

- For long-term value: Momentum's LifeReturns program offers compelling benefits if you maintain the policy

- For comprehensive coverage: Sanlam offers the most robust disability and extended benefits

But here's my real advice: Don't make this decision based solely on what you've read here. Finding affordable life insurance in South Africa that truly meets your needs requires personalization. Your health, income, and family situation matter enormously in determining which provider and policy structure is truly best for you. Get personalized guidance from our insurance experts.

I'd love to hear your thoughts. What factors matter most to you when choosing life insurance? Have you had experiences with any of these providers? Drop us a comment on our socials or reach out for a personalized consultation.